Unlocking Your Retirement Years: A Guide to Assessing Your Home for Future Needs

The Equity in Your Home Is The 🔑

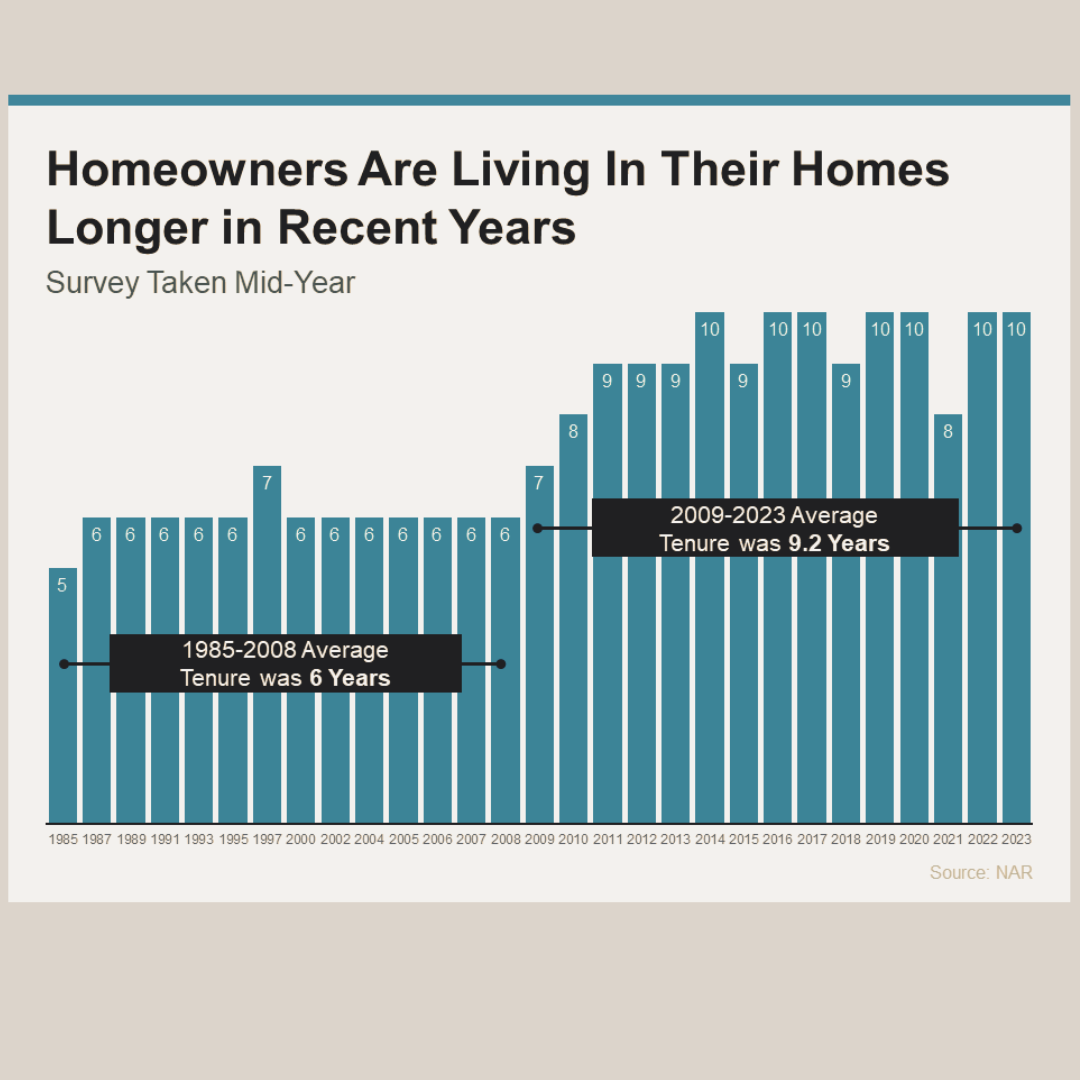

According to the National Association of Realtors (NAR), from 1985 to 2008, the average length of time homeowners typically stayed in their homes was only six years. Today, it’s an average of 10 years. Today’s seller has more equity in their home as a result of living in their home for a longer period of time.

.png?w=851)

Equity and The Upcoming Sales Trend

Data from the Federal Housing Finance Agency (FHFA) suggests that since 1991, home prices have increased a whopping 306%, and 58% over the past 5 years. The upcoming 5 years are not expected to achieve the same level of appreciation as we’ve experienced over the past 5 years, but will continue to increase in value nonetheless. 2023 was a tough year in real estate due to the year-end peak of interest rates, but inflation and job growth will be necessary to watch.

Pro Insight:

Realtors like myself, as well as industry experts alike recognize that buyers have become more acclimated to the higher interest rates, and as they see improvements with the rates, they will become more interested in jumping back into the market. Increased buyer competition means a stronger increase in home sales price.

.png?w=851)

How to Use the Equity You’ve Earned to Make Retirement Dreams a Reality

NAR data indicates that today’s typical buyer is 60 years old. For all sellers, data shows that the most common reason for selling their home was the desire to move closer to friends and family (23%) and 33% of sellers moved to a smaller home. Multigenerational homes ranked at 14% of home buyers in order to care for aging parents, children over 18 years of age who have moved back home, or for cost savings.

As a real estate agent specializing in helping retirees, I'm here to guide you through this exciting transition. Whether you're dreaming of a cozy, manageable space or moving closer to loved ones, let's find the perfect home for your retirement. ![]()

![]()

.png?w=851)

Are you or a loved one is in need of downsizing or becoming empty nesters?

You Got It!

We hope this helps you begin your process of downsizing or empty-nesting. We're excited to start this journey with you.